This introduction is broken into three parts.

- Investors looking for reasons to trade volatility funds in the age of active Central Bank intervention should start here

- Investors who already trade volatility and are seeking to gain an edge should go to the Profit From Volatility section.

- Subscribers who needed a refresher on the terminology and formulas, should go to the Volatility Terminology section.

Pitfalls of Stock Picking

Americans love the stock market and they love owning stocks. Every investor has read Peter Lynch's classic

"One Up On Wall Street: How To Use What You Already Know To Make Money In The Market".

There is nothing quite like using a great product or service then buying the shares of the company, hold them for the long term and make multiples of your original investment. It is the essense of capitalism.

Apple, Microsoft, GAP, Procter & Gamble, the list goes on and on. It's easy, buy an iPhone, own Apple and go on nice vacations with the extra profits.

And while it sounds easy in theory, in practice the reality is a little more sober.

For every success like Apple, there are five "failures" like Microsoft. While Microsoft is an excellent company, MSFT hasn't been a good investment since 2000,

when most investors of my generation were of age to invest. While Microsoft has tripled and quadripled its revenues and profits since 2000, the stock has been mired in a long term stagnation

The stock market is full of these types of "value traps". At the same time a company like Amazon or Salesforce, which haven't seen much profitability have skyrocketed.

Fundamental analysis alone does not explain or provide a clear guideline to success in the stock

market. Stock market prices are driven largely by sentiment and what the combination of institutional and retail investors think about a stock. It is positive sentiment and optimistic forward expectations that makes unprofitable stock push higher

and negative sentiment and pessimistic forward expectations that make a highly profitable dividend payer trade lower.

For every success like Apple, there are five "failures" like Microsoft. While Microsoft is an excellent company, MSFT hasn't been a good investment since 2000,

when most investors of my generation were of age to invest. While Microsoft has tripled and quadripled its revenues and profits since 2000, the stock has been mired in a long term stagnation

The stock market is full of these types of "value traps". At the same time a company like Amazon or Salesforce, which haven't seen much profitability have skyrocketed.

Fundamental analysis alone does not explain or provide a clear guideline to success in the stock

market. Stock market prices are driven largely by sentiment and what the combination of institutional and retail investors think about a stock. It is positive sentiment and optimistic forward expectations that makes unprofitable stock push higher

and negative sentiment and pessimistic forward expectations that make a highly profitable dividend payer trade lower.

In addition to the difficulty in spotting sentiment correctly (apart from the stock price not making any sense), individual stock investing carries substantial risk. An individual stock can lose 25% of its value in a single day if it disappoints on earnings. It can lose 50% of its value, if the chief executive resigns suddenly. It can lose 80% of its

value in a single day, if a class action lawsuit is filed against the company. Most of that happens without a forewarning and investors are left smarting about what happened. And once you lose 50%, you need to make 100% to get your money back. Finding stocks that double is much harder

than finding stocks that drop 50%. For that reason, most investors diversify their portfolios and invest in 10 or more individual stocks.

Tracking 10 or 20 different companies is tedious work, however. Checking the

earnings every quarter, reading SEC disclosures, following the business, evaluating competitive threats, etc is very time consuming.

If you are a professional worker like a doctor or an engineer, most of your time is spent keeping up with your professional requirements - learning new techniques, keeping certifications current, etc.

Between work and family, there isn't a whole lot of time to keep up with 20 stocks. So with the limited amount of time and information that people have, most retail investors are simply

gambling in a game that has much better odds than horse racing. Investors with truly successful portfolios are few and far in between. Among ten million investors, 0.1% or 100,000 will get the right combination of 20-30 stocks out of the 5000 issues that can be traded. Those 100,000 will consider

themselves good investors. But are they really good or is it just plain luck? If you are not a professional investor who spends all day poring over

SEC disclosures, chances are you are lucky and I can only hope you know it.

Rise of ETFs

The uncomfortable reality of stock picking has lead to the rise of ETF investing where investors get rid of individual company stock risk and instead trade a basket of stocks together usually bundled around a theme -

whether it is US economy via the SPDR S&P 500 ETF (SPY) or technology via PowerShares Nasdaq ETF (QQQ) or US treasury bonds via the iShares 20+ Year Treasury Bond ETF (TLT) or gold via the SPDR Gold Shares (GLD), etc.

There are now tens of thousands of ETFs for every taste and flavor.

ETF investing also brings the retail investor closer to the institutional investor.

Institutional investors are a group comprised of state and large company pension funds, college endowments, hedge funds, proprietary desks at banks and other deep pocketed investors. They generally look at the investment universe in terms of asset classes - stocks, bonds, commodities.

Every day they have to make decisions where to allocate their money - should they be in stocks, bonds or commodities. Most well run institution have investment committees comprised of portfolio construction specialists, risk specialists, economists and other market and stock research groups. All of them have to agree before an investment is made.

And they have a plethora of systems and investment tools built over time that enable them to make good decisions.

While retail investors now can allocate money in a similar way, they simply don't have the same decision making firepower. ETFs just like individual stocks move up and down and thus carry investment risk. Any given asset class or ETF can experience a 50% drawdown at any time. The S&P 500 Index (SPY) has had two 50% drawdowns in the last

15 years. The NASDAQ lost 80% of its value after the dot com bubble burst. Gold is currently in a 40% drawdown. The Japanese stock market went through an 80% drawdown over 20 years in the 90s and 00s. And while ETFs carry risk, the moves and the volatility are far less dramatic than invidividual stocks and as such should still be the prefered vehicle for investing.

The Ugly Mathematics of Investing

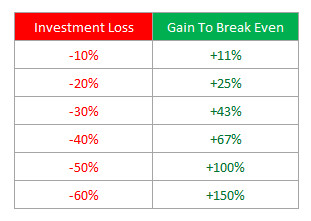

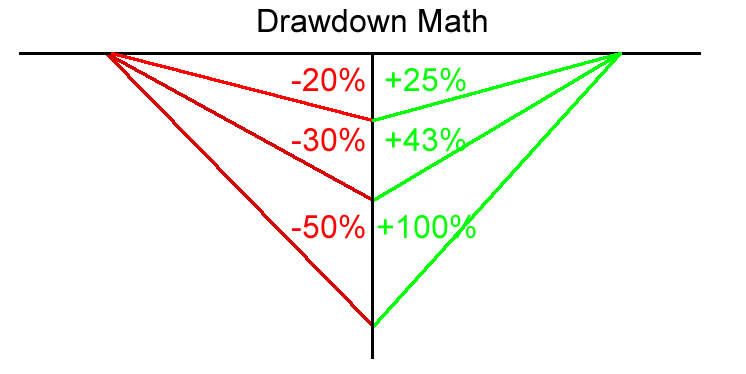

The mathematics of investment loss and getting back to even are very succinctly expressed by Warrent Buffet's famous maxim "Rule #1 of investing is don't lose money. Rule #2 look at Rule #1".

While most of the investment literature out there focuses on the beauty of compounded interest and the fantastic gains it can deliver over a long period time, what it conveniently

omits is that every asset has a price and that price fluctuates up as well as down. And if the price goes down over a sustained period of time, compounded interest/dividends may not be able

to recover your original investment. If your investment is down 20%, it needs to go up 25% for you to recover your original investment. If it goes down 30%, it now needs to go up 43% to break even. If

it goes down 50%, the gain required is 100%. If you lose 60%, you need to go up 150% to break even. The harder the investment falls, the bigger the climb required to get back to even. And once an asset class is

out of favor, it is not at all certain that it will gain traction again soon. Sometimes it takes decades for asset values to recover (see NASDAQ or Japan for example).

Rule #1 of investing is don't lose money. Rule #2 look at Rule #1

Large cap US stocks in the S&P 500 (SPX), which are underwritten in the reserve currency of the world and have had the explicit support of the Federal Reserve since at least Greenspan and are considered to be one of the safest investments in the world,

have had two 50% drawdowns in the last 15 years!

If an investor can experience a 50% drawdown in the S&P 500 index, he can experience far worse in any other asset class. So an investor still needs to make a decision when to be in an asset class and when to be out.

Sticking through the bad times is not a strategy that works in investing

Most new investors inevitably try to stick through the hard times as that is what works so well in real life.

But muddling through inevitably hurts the their net worth and investment capital. They have less than when they started. They could've used the money to buy something nice. Investors generally don't have 10 or 20 years to wait for their investment to recover.

Or maybe some do, but that is a lot of time lost waiting with nothing to show. Investors of the Gen X and later generations have lots of educational and mortgage debt. Unlike the baby boomers and earlier generations they didn't

have the option to spend 10K on education and 100K on a house. The numbers are at 100K and 500K now and younger investors simply don't have the luxury of getting in late on an investment. They also don't have the luxury of 10%, 7%, 5%, 3% or even 1% interest rates to help them save and accumulate an adequate financial cushion.

So inevitably, investors are confronted with the issues of valuation (is the investment expensive or cheap) and the issue of timing (should I get in/out now or later).

Timing the Market

While the mass media tends to frown on market timing and belittle it, the real truth is that market timing is the essence of capitalism. On a free market assets can be cheap and they can be expensive.

You can't realize wealth without selling. Before you sell, you need to buy. In order to be a buyer, you need to have capital. If you didn't inherit your capital, you must have sold something first to obtain that capital.

So the generation of wealth is a progression of buying and selling activities. Buying and selling is the defining feature of the US stock market and free market capitalism, not buy and hold.

In fact, America's best investors are market timers. Warren Buffet never buys an expensive stock. He waits until the valuation is below the fundamental cash flow valuation to buy. When the market doesn't

present properly valued opportunities, Warren Buffet waits patiently in cash. George Soros, David Tepper, John Paulson, etc - America's best private investors are market timers. In fact, even in the

banking system, market timers rule.

Lloyd Blankfein, the CEO of Goldman Sachs, is quietly considered to be the best market timer alive. Starting as a commodities trader at J. Aron & Company, he rose through the ranks to the top, engineered a marriage up acquisition by America's most prestigious financial institution and has successfully

navigated its trillions under management over the past 40 years through many bull and bear markets. And a replacement has been hard to find. His market timing skills are the reason why he still is the CEO of Goldman even through all the scandals that have marked his tenure.

So, au contraire, market timing is the essense of investing and a good investor should be able to time the market with reasonable precision.